Opiekun projektu

Katarzyna Zagórska-Ślązek

Project Manager

T +48 512 112 788

katarzyna.zagorska@advancedtrainings.pl

WE INVITE:

»» Board Members

»» Managers and Directors of Assets and Liabilities Management Departments

»» Representatives Treasury Department

»» Market risk, liquidity risk, interest rate risk Managers

»» Experts in controlling

»» Brokers

»» Heads of Risk Management Department

»» Auditors

MAJOR ISSUES:

»» IRRBB

»» Indices / benchmarks reform

»» Liquidity

»» FTP

»» Stress testing and reverse stress testing

»» Negative interest rates

»» LCR/NSFR

»» Strategic ALM

»» Behavioural modelling

»» Non-Maturity Deposits

»» Balance sheet management

Join us at ALM CONFERENCE in Warsaw! You will have an opportunity to get practical insights from the representatives of:

- European Central Bank

- European Investment Bank

- Czech National Bank

- Intesa Sanpaolo

- Mediobanca

- UniCredit

- Bank Pekao

- Commerzbank

- Nordea

- Financial Market Authority Liechtenstein

- ABN AMRO

- CREDIT SUISSE

- Getin Noble Bank

- Deutsche Bundesbank

WARUNKI UCZESTNICTWA

1. Przesłanie wypełnionego i podpisanego formularza zgłoszeniowego jest zobowiązaniem do wzięcia udziału w szkoleniu i uiszczenia odpłatności.

2. Rezygnacja z uczestnictwa wymaga formy pisemnej i potwierdzenia otrzymania jej przez organizatora.

3. W przypadku rezygnacji z udziału w szkoleniu na co najmniej 14 dni przed terminem szkolenia obowiązuje opłata administracyjna w wysokości 700 zł + vat.

W przypadku rezygnacji w terminie krótszym niż 14 dni przed rozpoczęciem szkolenia obowiązuje pełna odpłatność jak za udział w szkoleniu.

4. W przypadku braku udziału w szkoleniu bez wcześniejszego powiadomienia obowiązuje pełna odpłatność jak za udział w szkoleniu.

5. Do ostatniego dnia przed szkoleniem istnieje możliwość wyznaczenia innego uczestnika (w przypadku braku możliwości wzięcia udziału w szkoleniu danej osoby).

6.Organizator zastrzega sobie prawo wprowadzania zmian w programie szkolenia lub jego odwołania z przyczyn niezależnych od organizatora.

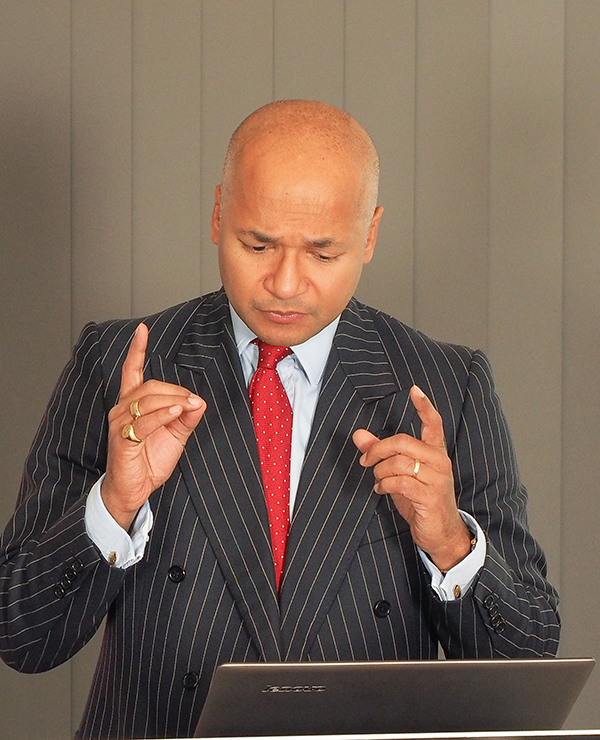

SPECIAL GUEST:

Professor Moorad Choudhry

The first 5 institutions which will register at least 3 participants will receive a copy of „Moorad Choudhry Anthology. Past, Present and Future Principles of Banking and Finance”

Zostaw komentarz